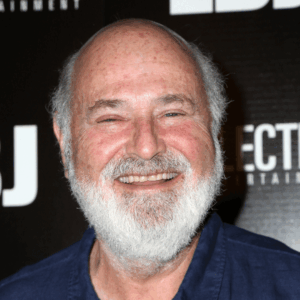

08 Dec COULD ROB REINER’S SON BENEFIT FROM KILLING HIS PARENTS? How does California & Texas law differ?

Nick Reiner, the son of Rob Reiner and Michele Singer Reiner, has been charged with violently stabbing his parents to death. Is there any way Nick could benefit from killing his parents? Like most states, California (where the Reiners were murdered) has a slayer statute whereby you can’t inherit from someone you killed. The California law states that if one feloniously and intentionally kills their parents, then that person could not receive any property, interest, or benefit of the decedent or in which the decedent has an interest. You also lose your right to be a fiduciary (executor, trustee or administrator) if you are the murderer. However, slayer statutes vary from state to state (Texas is different than California as described below).

What if Nick is not convicted of a felony? What if he is found not guilty as a result of his mental issues (Nick had well-documented addition issues – he was in rehab at least 18 times)? Would a determination of murder by a civil court instead of a criminal court suffice to result in disinheritance? This remains to be seen. So, does intentionally killing a parent without conviction of a felony result in disinheritance? It seems like the word “intentionally” is a policy choice by California to protect wrongdoers who are innocent of any intent to kill (i.e. accidentally killed). Many legal experts in California suggest that Nick should lose his inheritance (whether by will, trust, beneficiary designation, etc.) even if he is held accountable for murder by a civil count. Under civil law, determination is made by a preponderance of the evidence standard. Criminal law conviction requires a determination of guilt beyond a reasonable doubt. For example, O.J. Simpson was not convicted of murdering his wife, Nicole Simpson, and Ron Goldman, but a civil court determined that he was liable for their murder. It is possible that one could argue that Nick is entitled to a portion of the estimated $200 million estate of his parents until he is convicted of a felony (and he has hired a high-powered lawyer to represent him) which would result in a smaller estate to the other beneficiaries of the Reiner’s. Rob had 2 other children of his marriage to Michele, and one child whom he adopted when married to Penny Marshall.

Although Texas has a slayer statute, it only applies to life insurance policies when someone kills the insured, and the killer is named as a beneficiary. Preponderance of the evidence against the killer is all that is required in connection with collection (or not being a beneficiary) of life insurance proceeds. Texas courts have used a common law-constructive trust doctrine to prevent killers from benefitting from the one they killed. In other words, Texas allows the right to inherit but doesn’t give the killer a beneficial interest. The killer is prevented from using or transferring the inheritance by having a constructive trust in favor of the other heirs. There must be a showing of the breach of a fiduciary relationship and unjust enrichment. This puts the onus on a heir to sue for a constructive trust over the property to be inherited by the murderer. Thus, a lawful heir must spend attorney’s fees for a lawsuit to plead a constructive trust to the court (which wouldn’t be recovered under Texas law) – which may result in an economic decision if the estate is not large. Perhaps Texas should review and modify its slayer statute.

Although slayer statutes differ by state, the basic premise remains the same – no one should benefit from killing their parent.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.