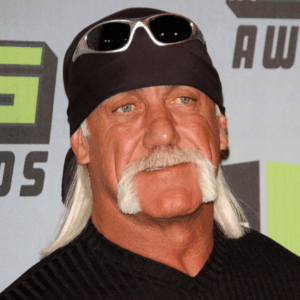

22 Sep WILL ANY OF HULK HOGAN’S HEIRS BE BODY SLAMMED IN ESTATE BATTLE ROYALE?

The combination of a large estate, a dysfunctional family, and Florida’s laws giving a surviving spouse the right to elect a portion of the deceased spouse’s estate (even if not named as a beneficiary) could result in a battle over Hulk Hogan’s estate, estimated at $25 million.

Hogan was married three times. He had 2 children, Brooke & Nick, from his first marriage. It is well known that Brooke had a roller-coaster relationship with her father. According to a New York Post report, Brooke did not attend Hogan’s wedding to his third wife, Sky Dailey. She also didn’t attend his funeral although she did have a private celebration of his life.

Brooke did not trust Hogan’s advisors, whom she thought were taking advantage of him. In 2023, she requested that both she and Hogan’s financial advisor to be removed as beneficiaries of his estate. Hogan’s will was filed on September 9 and Brooke was not named as a beneficiary. Hogan’s son, Nick, was named as the sole beneficiary of the will. Assets that are to pass by Hogan’s will are estimated at $5 million, which mostly consists of his right to publicity (name, image, and likeness) in addition to personal and intellectual property (such as trademarks and copyrights). Additionally, there is a potential lawsuit for medical malpractice against the doctor who is alleged to have severed a nerve in Hogan’s neck 2 months before his death. Nick has requested to be a co-representative of the estate pursuant to the will. As a representative he can pursue the suit for malpractice.

Some reports have suggested that Hogan had trusts to maintain privacy and shield his assets from lawsuits. Brooke is named as a beneficiary in a separate life insurance trust established by Hogan.. Furthermore, there is uncertainty as to who is the beneficiary of Hogan’s $11 million Florida home which consists of 2 beachfront properties. The filing with the courts by Nick did not include the home, which was Hogan’s most valuable asset. Public records show the properties were deeded to a LLC and trust which included Hogan and his former wife, Linda. If Linda had a member interest in the LLC, then she could own a portion of the home where Sky (Hogan’s widow) now lives. Will one of Hogan’s spouses be taken to the mat?

There could also be a skirmish between his other beneficiaries and his third wife, Sky, due to Florida’s spousal elective share rules whereby Sky is entitled to receive at least 30% of Hogan’s estate – even if she was not named as a beneficiary of his will or trust. Whatever Sky receives (especially if more than the elective share) will lessen what might otherwise go to his descendants, which could increase the probability of a contest.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.