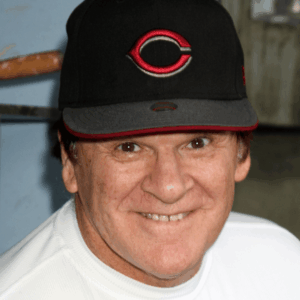

20 Oct PETE ROSE’S ESTATE PLANNING STRIKES OUT

Fabled and infamous baseball legend, Pete Rose, will never enter the Estate Planning Hall of Fame. He had no will when he died last year. The only “planning” he did was to sign (6 months prior to his death) a licensing agreement with his agent, John Maguire, over control of Rose’s name, image and likeness (NIL) for 50 years (pursuant to Nevada’s postmortem right of publicity statutes). This is likely to be more valuable than the actual value of his estate at the time of his passing. In May 2025, Rose was removed from the list that made him ineligible for Major League Baseball’s Hall of Fame. If Rose is admitted to the Hall of Fame, his endorsement and licensing value can soar.

Maguire has requested of the court that the licensing agreement is not subject to probate. Pursuant to the terms of the agreement, Maguire would receive a 5% commission on any deals and 5% for expenses. The net profits were to be equally shared between Rose’s assistant, Dawn Plancarte, and his 2 sons, Tyler and Pete Rose, Jr. His daughters were not named as beneficiaries. However, there were several handwritten amendments (including one adding Plancarte as a beneficiary). Plancarte signed the agreement as a witness. As a result, this puts the validity of the contract with Maguire in jeopardy. Under Texas law, if one is both the beneficiary and witness of the will of the deceased, such beneficiary is disinherited unless all other beneficiaries agree otherwise. Rose was a Nevada resident at the time of his death.

Rose was not married at the time of his death. He had 5 children who survived him. Fawn and Pete Rose, Jr. from his first marriage, Tyler and Cara from his second marriage, and Morgan who was not born of a marriage. Under laws of intestacy (when one dies without a will) the closest heirs (i.e., the children) would inherit.

Since there was no will (resulting in no named executor), an administrator would need to be appointed. Initially, Fawn (who did not reside in Nevada) and a Nevada resident, Amber Fletcher, were appointed co-administrators of the estate. However, Tyler has requested that Fawn be removed and he be appointed since he knew more about his dad’s assets and business. Tyler also alleges that his dad told him that he had an estate plan in which he and Pete Rose, Jr. were the only beneficiaries. Fawn counterclaims that Tyler took assets belonging to the estate.

The Nevada court will have to determine who is in control of Rose’s estate and the valuable postmortem NIL and licensing rights which are good for 50 years under Nevada’s right of publicity laws.

Pete Rose, a 17-time All-Star and holder of the record for most hits, was no star when it came to estate planning. He struck out. His gamble on having no will or trust will result in ineligibility for the Estate Planning Hall of Fame.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.