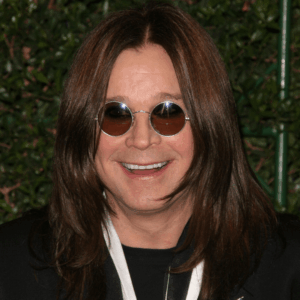

11 Aug DID THE PRINCE OF DARKNESS (OZZY OSBOURNE) HAVE ENLIGHTENED ESTATE PLANNING?

Sharon Osbourne (wife of the late rock and roll singer, Ozzy Osbourne) once said, “I don’t want someone who has never met my husband owning his name and likeness and selling t-shirts everywhere. No, it stays in the Osbourne family.”

However, did he have proper estate planning?

At the present time, it is unknown whether Osbourne had a will or trust or both, but there must be many issues to consider for a musical celebrity in his or her estate planning – not only for the transfer of his present estate (worth over $200 million), but also future earnings for his copyrighted compositions, interest in his “Black Sabbath” trademark, interest in any royalties, licensing rights, sound recordings besides his name, image and likeness (such as his voice and any of his characteristics) which could add hundreds of millions to his estate in the future.

Osbourne had dual British and U.S. citizenship, but he resided in England at the time of his death. Proper jurisdiction is normally where you reside at the time of your death (not where you die). So, did Osbourne plan for if there were assets held in the U.S.? If a will is probated in England, then often there is ancillary probate if there is property in the U.S.

Osbourne owned U.S. copyrights to his compositions (melody and lyrics). However, the sound recording copyright (the master right) to some of his music may be owned by the record companies if a record deal is involved. Black Sabbath had record deals with Vertigo in Britain and Warner Bros. in the U.S. (among others).

Osbourne’s U.S. copyrights should be valuable. Pursuant to copyright law, the composer, his or her spouse, or his or her heirs has a “termination right” (including assignment and licenses agreements) 35 years after the agreement if made after January 1, 1978 (previously it was 56 years from the copyright date). This is good for 5 years. This gives the author or composer or his or her heirs the ability to reclaim rights. However, although a copyright can be transferred to a trust, copyright termination rights are only available to the author and the author’s spouse, and the author’s heirs (i.e., spouse, child, grandchild) – even if you disinherited them. However, works made for hire are not subject to termination. If the copyright assignment or license had a termination and copyright reversing provision upon the author’s death, then the author (i.e., Osbourne) can give to whoever he or she wanted at death or his or her will.

Osbourne and fellow Black Sabbath member Tony Lommi co-owned (not other band members) the trademark “Black Sabbath”. A trademark can be owned by a trust. So the question would be whether Osbourne would want both a will and a trust. A partial interest in the trademark (in this case, ½) could be transferred to a trust if Osbourne wanted to avoid probate in addition to management of the trademark. If the trust owned the trademark, then any licenses would be made between the trust and the entity purchasing the license.

Finally, the name, image, and likeness (NIL) of celebrities is often very valuable even after death. Marilyn Monroe died decades ago, but her NIL, also known as the “Right of Publicity,” continues to make millions annually through the commercial use of her image and likeness. Right of Publicity is considered intangible personal property (other intangible personal property includes cash, stock, patents, copyrights, goodwill, trademark, and tradename). It can be transferred to a trust. Often this is done for management purposes, as there is no delay as might otherwise be required if a will were probated. A trust can make sure NIL is professionally managed, including brand protection, even during disability, while still being private (unlike guardianship or probate).

In Texas, a person who claims to own a property right may register the claim with the Secretary of State after the death (no need to register it before death as there is a common law right) to use the deceased individual’s name, voice, signature, photograph, or likeness. This is evidence of a valid claim, and a registered claim is superior to an unregistered claim unless a court invalidates the registered claim. For the first year after death, an owner of a property right may only exercise if the owner registers a valid claim. The right of publicity is only good for 50 years after death (assuming it still has commercial value). There are certain exemptions to right of publicity claims, such as new stories and political content.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.