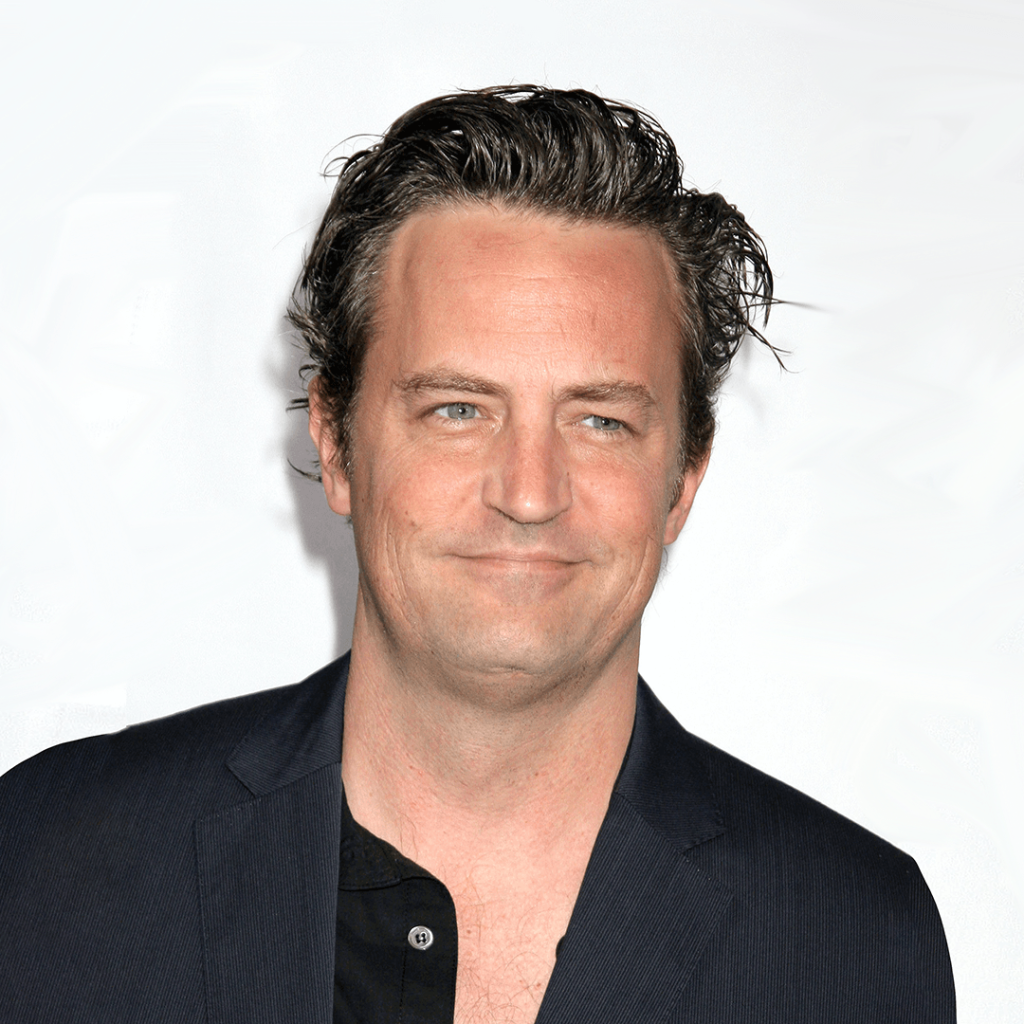

26 Aug Matthew Perry’s Estate Plan – A Friend to Many Even After Death

Matthew Perry, well-known for his role as Chandler Bing in the popular television show “Friends”, preferred that he be remembered for helping others. Perry, who fought his addiction to alcohol and opioids for many years prior to his death last year at age 54, may have done that in his estate planning with the establishment of the Matthew Perry Foundation.

The majority of Perry’s assets (estimated at $120 million) were held in a revocable living trust entitled the “Alvy Singer Living Trust” which was named after Woody Allen’s character in the movie “Annie Hall”. You can name your trust anything you want which makes it more difficult for others to know of your assets held in trust.

Two of many advantages of a revocable living trust are privacy and the avoidance of probate. Perry apparently only had $1.5 million in an individually owned bank account (and some personal property) of his substantial estate that was not held in his trust. Typically, when one has a revocable living trust, there is a “pour-over” will” to transfer the assets that were not re-titled in the name of the trust. Perry has a “pour-over will” (which is being probated) which names his trust as his beneficiary. Famous actors (such as Perry) should always have a will in addition to a trust since there are assets that may not be funded into the trust until after death such as his payment for use of his name, image and likeness, use of his voice through artificial intelligence (as evidenced by recent contracts by a company with the estates of Judy Garland and Burt Reynolds) or future residuals for replay of his television performances (which Perry receives $20 million per year) although he may have named his trust as the beneficiary of his residuals.

Since a trust (unlike a will) is private, there is uncertainty as to the terms of the trust. The will of Perry named his parents, former girlfriend and a half-sister as beneficiaries. He was not married and did not have children. In fact, his estate planning documents specifically disinherited any children to reduce the risk anyone would claim to be his child. If Perry just named individuals as beneficiaries of this estimated $120 million estate, then there would be a substantial estate tax (approximately 40% of the excess over $12,920,000 – the estate tax exclusion in year 2023).

However, there is a likelihood that Perry considered charitable giving to reduce estate taxes. About a month after Perry’s death, the Matthew Perry Foundation was established as a donor-advised fund to help those with addictions. Perry wanted to help others who have addiction issues like he did. The foundation doesn’t run programs that help those with addictions – it just gives funds to organizations that help those with addictions.

When you make a gift to a donor-advised fund, you receive an immediate tax deduction and you can direct where the funds go at a later date. It can be established in life or be a beneficiary at your death.

While Perry will probably be best remembered for being a main character in “Friends”, his estate planning likely dictated to others with addictions “I’ll be there for you”.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.