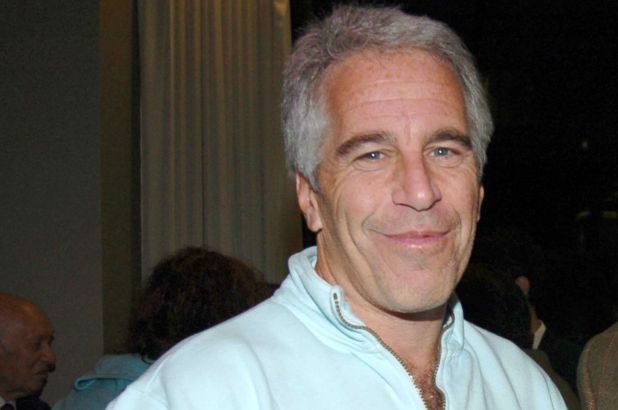

26 Aug JEFFREY EPSTEIN’S WILL – FIVE LEGAL ISSUES LEFT TO BE DECIDED

Jeffrey Epstein’s signing of a Will two days before his suicide leaves many legal issues that may take more than a decade to decide. By creating a “pour-over Will” into a trust he created, we know that he has planned for privacy on who are his beneficiaries and how his assets (estimated at over $577 Million) are to be distributed. It could have been worse for his victims if he had established his trust years ago (before any claims against him had been threatened) and re-titled (or funded) the assets in the name of the trust as it would have been more difficult for his victims to get his assets out of the trust than the present situation whereby the assets are not “poured” into the trust until the claims against his estate are resolved. So, privacy and manner of distribution may be irrelevant if everything is first paid to claimants (including the IRS and the sexual abuse victims).

Although not exclusive, the following is a list of issues that will be resolved in the years to come:

1. Did Epstein have testamentary capacity?

Epstein was suicidal and there could be a question as to his testamentary capacity. However, it could be argued that his

2. Was the Will properly signed and witnessed or otherwise met the legal requirements for it to be valid?

Domicile matters. The laws of each jurisdiction are different. Often witnesses are required to be there when the person signs the Will. In Texas, the Will should be witnessed by two disinterested persons over age 14 who should witness the signing not only in the presence of the testator (the one who signs the Will) but in the presence of each other. If this is done before a notary, then the Will is “self-proved” under Texas law (which means witnesses would not even be needed to go to court to prove up the Will). In this case, the Will was filed in the Virgin Islands which is where he had

3. Was there

Epstein was obviously contemplating suicide. It is common for those considering such action to do a Will. Since he may have made it more difficult to collect, some may argue this was a fraud upon his creditors. However, since the trust was not funded, this issue is merely academic. Even if the trust was funded, it could have been set aside as a fraudulent transfer since he was facing criminal charges and there was only a couple of days between his preparation of the trust and his death. However, the creditors or claimants would still have to sue to get the assets out of the trust.

4. Will the IRS prevail over the claims of the sexual abuse victims?

5. Will federal prosecutors seek Epstein’s assets through a civil forfeiture proceeding?

Although criminal forfeiture proceedings are more common which cannot be pursued in this case due to Epstein’s death, there is precedent for civil forfeiture proceedings as the Department of Justice brought a civil forfeiture proceeding against the CEO of Enron who died while facing fraud charges. Due to the size of the estate and the many victims, this could happen.

If interested in learning more, consider attending our next free “Estate Planning Essentials” workshop by calling us at (214) 720-0102 or sign up by clicking here.