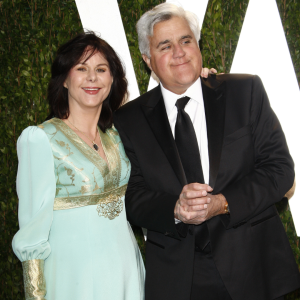

04 Mar Jay Leno’s Lack Of Estate Planning Results In Seeking Conservatorship Over Wife Will His Car Collection Crash?

Jay Leno has filed a petition in a California court to seek conservatorship over his wife, Mavis, who is believed to have Alzheimer’s Disease or some other form of dementia. Leno is seeking conservatorship since Mavis no longer has sufficient mental capacity to do an estate plan. California is a community property state. He seeks authority under California’s laws on substituted judgement to approve the creation of a trust or other estate planning document so that her assets could be distributed in a way that she would want if she had sufficient mental capacity. Texas laws are different, and it is best to create your own will or trust while you still have mental capacity as Texas courts will not do this for you. Leno has a will, but that is inadequate for his desired plan.

Jay and Mavis have been married since 1980. As a result, the great majority (if not all) of their property is probably community property pursuant to California law. They have no children. Mavis, 77, does have a brother. Leno’s brother passed away over 20 years ago. Neither Jay nor Mavis have parents that are still alive. Jay has indicated in his petition that he wants to provide for Mavis and her brother.

Although it is uncertain as to the estate planning Leno will be seeking other than the creation of a trust, his collection of valuable cars (approximately 300) is well-known which should be a consideration in his planning. Jay and Mavis live in California where probate is costly and time-consuming. So, it is unlikely that a will plan is best for them.

Leno could retitle his cars to a trust. The trustee of the trust could be the owner, and Leno could be the insured. There are certain laws in California dealing with the age of the vehicle (vintage, which are cars that are prior to 1930; antique, which are cars at least 35 years old; and classic, which are at least 25 years old). Retitling the multitude of cars Leno has would be burdensome. However, he could be trustee of a revocable trust and manage all of the assets of he and his wife if the court so permits. It should be noted that a revocable living trust gives you no more creditor protection than if you own a car in your own name. A revocable living trust has no affect on your income taxes. However, various planning options are available in a revocable living trust for estate tax planning (Texas, unlike California, has no state estate tax).

The federal estate tax limit in 2024 is $13,610,000. Leno has a taxable estate. Furthermore, California has an additional capital gains tax (additional to federal tax law). So, if Leno sold any of his vehicles that had appreciated in value, then there could possibly be a large capital gains tax (30% of the gain) whereas if he held the cars that appreciated in value until his death, then the basis would be re-calculated to the value as of the date of his death. If the cars are kept until death, it is likely a major auction house would be used due to the value of Leno’s car collection. This could be arranged in advance to lower the costs to be paid to the auction house.

Leno could consider giving some of the cars to a public charity related to cars so he could get the full appreciated value as an income tax deduction. If not given to a public charity related to cars, then he could only deduct the purchase price. If given after death to any charity, it would not matter as it would be a federal estate tax charitable deduction at fair market value of the cars.

Another option for Leno would be to set up a private operating foundation. He would probably establish a car museum. Leno would then be able to get a tax deduction equal to the value of the cars given to the museum. The private foundation could be set up during his life or at his death. If established at death, there would be an estate tax charitable deduction.

The hearing for conservatorship is set for this April. Whether the court would permit Leno to create a trust, foundation, etc. is presently unknown. Usually, dementia gets worse over time. Leno’s failure to adequately plan while Mavis still had sufficient mental capacity results in uncertainty as to what the court will permit for his desired planning.

Although most do not have the size of estate or car collection that Jay Leno has, the lesson for all is to plan before it is too late.

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.