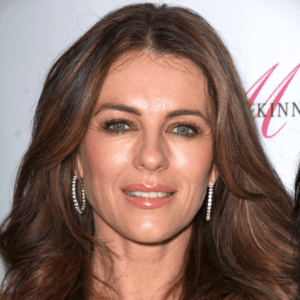

09 Jun CELEBRITY CASE UPDATE: ELIZABETH HURLEY’S SON LOSES MILLIONS FROM TRUST DUE TO BEING ILLEGITIMATE

A California appeals court has ruled that neither Damian Hurley (whose mother is famous actress, Elizabeth Hurley) nor Kira Bonder, the illegitimate children of the late Stephen Bing, could receive hundreds of millions of trust funds from their paternal grandfather, Dr. Peter Bing, since they were born out of wedlock. The court overturned a lower court decision in favor of Damian and Kira.

Dr. Peter Bing created irrevocable trusts in 1980 for the benefit of his grandchildren before he even had grandchildren. Dr. Peter Bing had two children, Mary and Stephen. Mary had 2 children born of her marriage. Damian was born out of an unmarried relationship between Stephen and Elizabeth Hurley and Kira was born out of an unmarried relationship between Stephen and Lisa Bonder. Kira was determined to be the child of Stephen, who initially denied she was his child, after a private investigator (hired by Lisa’s former husband, multi-billionaire, Kirk Kerkorian) took dental floss from Stephen’s trash. The DNA from the dental floss established paternity. Since Damian and Kira are grandchildren, the lower court determined they should be beneficiaries.

However, the appeals court reversed for a few reasons. The trust stated that the trustee had the “power to construe this Declaration of Trust, and any reasonable construction adopted after obtaining the advice of responsible legal counsel shall be binding on all persons claiming an interest in the trust estate as beneficiaries or otherwise”. The trustee did not think Kira and Damian should be beneficiaries.

Additionally, Dr. Bing stated in an affidavit in 2018 “when I created the [grandchildren’s] trusts, I believed that they would not benefit any person born out of wedlock unless that person had lived for a substantial period of time while a minor or a regular member of the household of the parent who is a natural child of mine”. Since neither Damian or Kira fit that description, he didn’t consider them a grandchild. The appeals court took Dr. Bing’s affidavit into consideration.

However, more importantly, the appeals court reviewed the California Probate Code which states:

“In construing a transfer by a transferor, a person born to the natural parent shall not be considered the child of that parent unless the person lived while a minor as a regular member of the household of the natural parent or of that parent’s parent, brother, sister, spouse, or surviving spouse”.

The court determined the trustee’s decision to exclude Kira and Damian was reasonable since “the law long before the execution of the trust would have excluded all children born out of wedlock from the definition of “grandchild” and the law in effect now has liberalized to the point of excluding only out-of-wedlock grandchildren who have lived as regular members of the household of the natural parent through whom they claim”.

The court decision costs both Kira and Damian several hundred million dollars.

In Texas, bloodline is determinative.

It should be mentioned that when Stephen Bing received funds outright, he proceeded to go through $600 million (Dr. Peter Bing was a real estate tycoon).

Estate planning lessons to be learned from this case:

#1. Definitions in your will or trust should be clear

The drafter of Bing’s trust could have easily stated that descendants born out of wedlock are to be excluded.

#2. Trusts can be used to protect a beneficiary

Stephen Bing was a spendthrift. Often trusts are created within a will or a trust to protect the beneficiary who spends money as soon as they receive it. Furthermore, what if the beneficiary was too immature to handle funds? What if the beneficiary had creditors or was disabled? What if the beneficiary has an addiction?

#3. Laws of each state differ

If you move from one state to another, you should consider the laws of the state where you reside. If you moved from California to Texas and you have a California trust which states the laws of California prevail, are you sure that is what you want as this case illustrates?

If interested in learning more about this article or other estate planning, Medicaid and public benefits planning, probate, etc., attend one of our free upcoming Estate Planning Essentials workshops by clicking here or calling 214-720-0102. We make it simple to attend and it is without obligation.